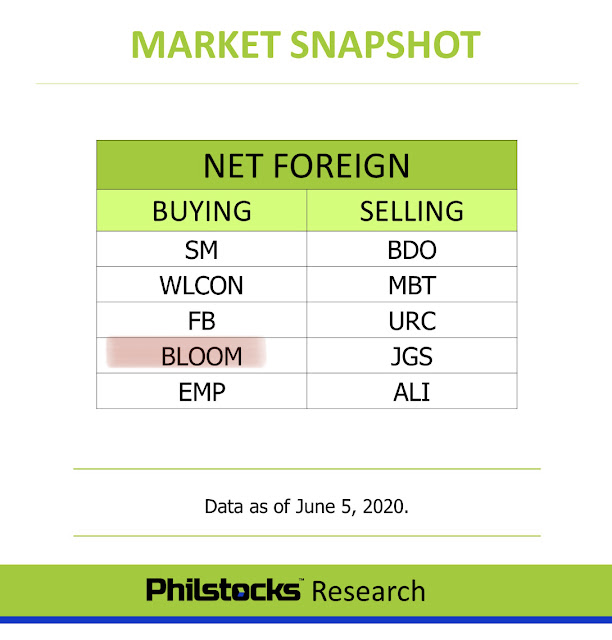

BDO Unibank Inc. (BDO), originally known as Acme Savings Bank, was acquired by the SM Group in 1976. BDO listed its shares on the Philippine Stock Exchange on May 21, 2002. The Company merged with Equitable PCI Bank in May 2007.

BDO offers an array of products and services, i.e. retail banking; lending (corporate, commercial, consumer, and SME); treasury; trust; credit cards; corporate cash management; and remittances. Through its subsidiaries, the Company offers leasing and financing; investment banking; private banking; bancassurance; insurance brokerage; and stock brokerage services.

The Company's local subsidiaries include BDO Private Bank, Inc.; BDO Leasing and Finance, Inc.; BDO Capital & Investment Corporation; BDO Nomura Securities, Inc.; and BDO Insurance Brokers, Inc. The Company also has foreign subsidiaries in the US, Hong Kong, Italy, Japan, Canada, and Macau. The Company's associates include NLEX Corporation; SM Keppel Land, Inc.; Northpine Land Inc.; Taal Land, Inc.; and MMPC Auto-Financial Services Corporation.

As of December 31, 2018, BDO has 1,309 operating domestic branches (inclusive of one branch each in Hong Kong and Singapore), 4,325 automated teller machines and 484 cash deposit machines.

As of June 29, 2020, BDO was last traded at 94PHP per share. Its market price is 41.9% lower from its 52 week high. Is this fundamentally cheap and technically time to buy?

Trailing P/E = 9.4 Indicating that for every 1php income last 2019, investors are willing to pay 9.4php.

Trailing PEG Ratio = 0.3, meaning, investors are willing or is paying 9.4php for every peso income last 2019 relative to growth growth rate of 35.4% which is the change of EPS from 2018 to 2019. A PEG ratio of less than 1 is considered undervalued.

Price to Book Value per share (P/B) = 1.1, meaning, the current market price per share is just 1.1 times higher that the real worth of the company as based on their March 2020 financial report. Usually, a P/B of less than 3 is considered undervalued.

Technically, the MACD momentum is in selling signal. RSI also is indicating a continuation of selling. If I’m the investor, I would wait first for a sign of momentum reversal and not enter yet, but fundamentally, this is a good stock to accumulate.

Disclaimer: Trade or invest at your own risk.