Bloomberry Resorts Corporation (BLOOM), formerly Active Alliance, Incorporated, was registered with the Securities and Exchange Commission (SEC) on May 3, 1999. BLOOM was a manufacturer of consumer communication and electronic equipment operating in Subic Bay Freeport Zone until 2003, when it suspended business operations. In February 2012, the SEC approved the change in its corporate name to the present one and the change in its primary purpose to that of a holding company for hotel and/or gaming and entertainment business companies.

The Company is the owner and operator (through its subsidiaries) of Solaire Resort & Casino (Solaire), the first integrated resort at the Entertainment City in Parañaque City, Metro Manila. The Company has marketing presence in Korea, Macau, Hong Kong, Singapore, Malaysia, Indonesia, Thailand, Taiwan and Japan.

The subsidiaries of the Company are: Sureste Properties Inc. (SPI), which owns and operates the hotel and other non-gaming facilities in Solaire; Bloomberry Resorts and Hotels, Inc., which has a gaming license from the Philippine Amusement and Gaming Corporation, and owns and operates the casino in Solaire; Solaire Korea Co. Ltd. and its subsidiaries Golden & Luxury Co., Ltd., which owns, and has a gaming license to operate, Jeju Sun Hotel & Casino, and Muui Agricultural Corporation, which owns prime real estate in Muui Island in Korea; and Bloom Capital B.V., which owns Solaire de Argentina S.A.

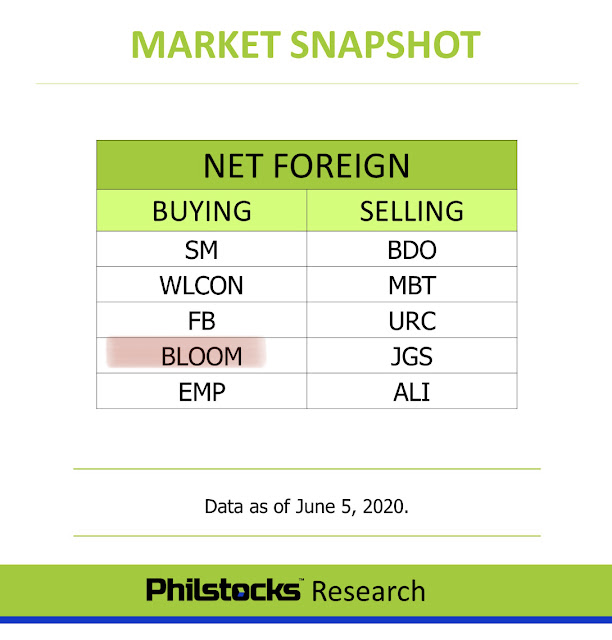

As of June 10, 2020, BLOOM was last traded at 7.88php per share. BLOOM is one of the listed company. It’s market price dropped by at least 30% from it’s 52 week high, largely because of the COVID19 pandemic, but is it now fundamentally cheap to buy?

In terms of P/E, BLOOM recorded a trailing P/E of 8.76, meaning, for every 1PHP earning last 2019, investors of this company are willing or is paying 8.76php. With a 8.76 P/E and with a growth rate of 38.4% (change in EPS) from 2018 to 2019, the company trailing PEG ratio would be just 0.23, which would be considered undervalued since a PEG ratio that is less than 1 is generally considered undervalued.

In terms of book value per share, the current market price is currently 2 times higher than the book value as recorded in their March 2020 financial report, meaning the company is perceived to be 2 times higher compare to the real worth of the company. It seems in terms of this parameter, I say it’s still in the range of undervalued.

In terms of income, as per their March 2020 financial statement, expectedly due to COVID19, the income dropped by 37%.

Is this a good stock to accumulate fundamentally in this pandemic period? Based on the indicators above, it suggest that it is fundamentally cheap to buy in this pandemic period.

Disclaimer: Trade or invest at your own risk.

No comments:

Post a Comment