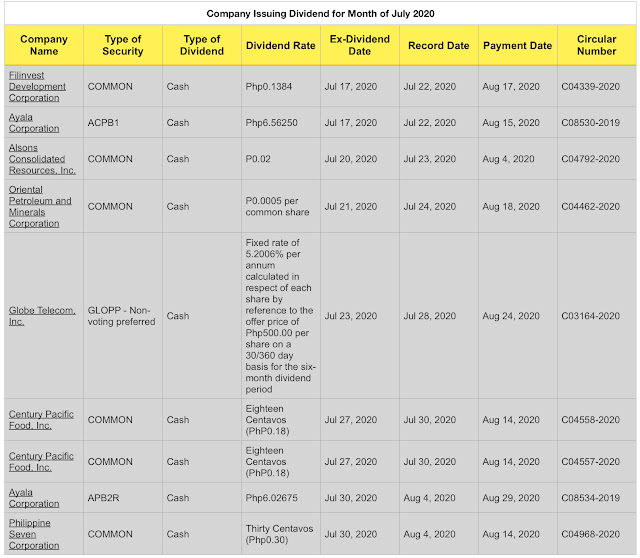

Source: PSE edge

Q1. What is Ex dividend Date?

A1. It means the date set by the Exchange starting from which the buyer is no longer entitled to the dividends. Currently set at 3 business days before record date.

Q2: What if I buy stocks before Ex dividend date, will I be entitled for the dividend?

A2. Yes, but if you purchase a stock on the ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

Q3: What if I buy stocks before ex dividend date but sell it before the record date or payment date, will I still be entitled for the dividend?

A3: Yes you will still be entitled, but note that by the time the stock is sold, it will decline in value by the amount of the dividend. The broker will get the commission and the buyer might just break even.

Why does the stock price decline right after the dividend is paid? Because that's the way the markets work.

Key Takeaways

- When a stock dividend is paid, the stock's price immediately falls by a corresponding amount.

- The market effectively adjusts the stock's price to reflect the lower value of the company, which could wipe out any gain sought by a short-term buyer.

- In addition, the buyer owes taxes on those dividends.

Click here for the source

Q4: What is record date?

A4: It means the date on which stockholders must officially own shares in order to be entitled to any shareholders rights or dividends, but if you buy share on this date, you will not be entitled, you must buy before ex dividend date to be entitled.

No comments:

Post a Comment